2021 Peer Group. Our peer group consists of one through five. A scorecasual dining, fine dining, quick casual and quick service restaurants with similar market capitalization and revenue. The Compensation Committee and independent directors considered the peer group in connection with their fiscal year ended December 26, 2021 executive compensation decisions. The Compensation Committee reviews the composition of three means the executive is a “Contributor,” four is a “High Contributor”peer group periodically and five is a “Star.” Annual cash compensation varies based onwill make adjustments to the executive’s score,peer group in response to changes in the size of business operations of the Company and of companies in the peer group, companies in the peer group being acquired or taken private, and other individual performance measures,companies in the restaurant industry becoming public. The table below lists the companies that were considered during the fiscal year ended December 26, 2021.

Casual Dining

Ark Restaurants Corp.

Chuy’s Holdings, Inc.

Denny’s Corporation

J. Alexander’s Holdings, Inc.

Luby’s Inc.

Fine Dining

Ruth’s Hospitality Group, Inc.

Quick Casual

Fiesta Restaurant Group, Inc.

Noodles & Company performance,

Quick Service

El Pollo Loco Holdings, Inc.

Del Taco Restaurants, Inc

Base Salary

The Compensation Committee generally reviews, and contributionsapproves adjustments to, Potbelly.

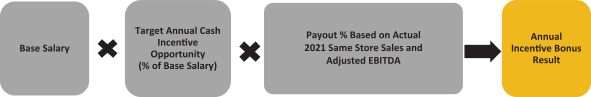

Executive pay is tied to both the Company’s and the individual’s annual performance. Merit increases, annual incentive compensation, stock options, when granted, and paid time off are generally awarded in March or April of each year, following completion ofbase salaries annually during the first quarter annual performance review cycle, the annual financial auditwith new salaries becoming effective in mid-April. Pursuant to his employment agreement, Mr. Wright agreed to an initial base salary of $1.00 until July 2021 at which time his base salary increased to $650,000 in line with market. Mr. Cirulis’ base salary is $425,000, Mr. Noyes’ base salary was initially $325,000 when he was hired in August 2020 and approval from the compensation committee. Thewas increased to $400,000 in September 2021 pursuant to his employment agreements of ouragreement. Ms. Dixon’s base salary is $275,000. From April 2020 to August 10, 2020, all named executive officers specify each executive’s annual incentive bonus target under our current bonus program. In addition, atduring that period agreed to a temporary 25% reduction in their base salary in an effort to mitigate the discretionimpacts of the compensation committee in the caseCOVID-19. The Company repaid 50% of our Chief Executive Officer, and at the discretion of our Chief Executive Officer and upon the approval of the compensation committee in the case of our other executive officers, there may be an increase or decrease applied to the annual bonus awarded to an executive, including the other named executive officers, in order to account for exceptional circumstances. However, it is anticipated that such bonuses would only be awarded under unusual circumstances to further the objectives of our compensation program. For example, the named executive officers received a discretionary cash bonus for the performance in fiscal year 2016. See“–Non-Equity Incentive Awards–2016 Discretionary Bonus” below.

In 2015, the compensation committee engaged Aon Hewitt to conduct an analysis of and provide recommendations for our director compensation programs. The compensation committee considered the benchmarking analysis provided by Aon Hewitt as well as market practice when forming their recommendation to the Board of Directors concerning appropriate compensation for members of our Board of Directors. The compensation committee also engaged Aon Hewitt in 2015 to conduct a competitive analysis of executive compensation. In 2016, Aon Hewitt provided consulting services modeling possible equity plan share request size and compliance with institutional shareholder advisor governance guidelines. Aon Hewitt is currently benchmarking executive equity compensation and is also engaged in a review of the CEO’s executive employment agreement. Aon Hewitt also provides the Company with consulting services concerning employee benefit plans.

| | | | | | | | |

EXECUTIVE AND DIRECTOR COMPENSATION | | | | | | |

2016 Summary Compensation Table

The following table summarizes compensation for the years ending December 25, 2016 and December 27, 2015 earned by our principal executive officer and our two other most highly compensated executive officers. These individuals are referred to as our named executive officers.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | | Salary | | | Bonus (1) | | | Option Awards (2) | | | Non-Equity

Incentive Plan

Compensation (3) | | | All Other Compensation | | | Total | |

Aylwin Lewis | | | 2016 | | | $ | 725,000 | | | $ | 300,000 | | | $ | 1,049,500 | | | $ | 0 | | | $ | 0 | | | $ | 2,074,500 | |

Chief Executive Officer | | | 2015 | | | $ | 725,000 | | | $ | 0 | | | $ | 0 | | | $ | 830,647 | | | $ | 0 | | | $ | 1,555,647 | |

(Principal Executive Officer) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Michael Coyne | | | 2016 | | | $ | 383,221 | | | $ | 110,000 | | | $ | 200,000 | | | $ | 0 | | | $ | 0 | | | $ | 693,221 | |

Chief Financial Officer | | | 2015 | | | $ | 244,162 | | | $ | 0 | | | $ | 1,039,050 | | | $ | 167,845 | | | $ | 0 | | | $ | 1,451,057 | |

(Principal Financial Officer) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Matthew Revord | | | 2016 | | | $ | 357,673 | | | $ | 100,000 | | | $ | 180,000 | | | $ | 0 | | | $ | 0 | | | $ | 637,673 | |

Chief Legal Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) | The amounts shown in the Bonus column represent discretionary cash bonus payments. See“–Non-Equity Incentive Awards–2016 Discretionary Bonus” below. |

(2) | Represents the aggregate grant date fair value of stock option awards. |

| The Company issued stock option awards to Mr. Lewis in 2016 in recognition of his individual performance during the 2015 fiscal year. Mr. Lewis was granted 100,000 options in March of 2016 and 50,000 options in May of 2016, all of which are exercisable without restriction and vest over a period of four years. The Company used the following assumptions for purposes of valuing these March and May option grants, respectively: common stock fair value of $13.73 and $13.27 per share; expected life of options—seven years; volatility—49.49% and 48.91%; risk-free interest rate—1.69% and 1.54%; and dividend yield—0% (for both grants). The Company used the simplified method for determining the expected life of the options. |

| The Company issued 28,145 stock option awards to Mr. Coyne and 25,331 stock option awards to Mr. Revord in March of 2016, which are exercisable without restriction and vest over a period of four years, each in recognition of his respective individual performance during the 2015 fiscal year. The Company used the following assumptions for purposes of valuing these option grants: common stock fair value of $13.73 per share; expected life of options—seven years; volatility—49.49%; risk-free interest rate—1.69%; and dividend yield—0%. The Company used the simplified method for determining the expected life of the options. |

| In May of 2015, Mr. Coyne was granted 150,000 options, which are exercisable without restriction and vest over a period of four years, in connection with his joining Potbelly. In accordance with ASC Topic 718, Compensation—Stock Compensation, fair value of the options was determined using the Black-Scholes-Merton option pricing model and will be amortized over the vesting period. The Company used the following assumptions for purposes of valuing these option grants: common stock fair value of $14.22 per share; expected life of options—seven years; volatility—45.28%; risk-free interest rate—1.89%; and dividend yield—0%. The Company used the simplified method for determining the expected life of the options. |

(3) | Our annual cash incentive awards granted pursuant to our Support Center Annual Incentive Plan are included in theNon-Equity Incentive Plan Compensation Plan column, to the extent such awards are earned. Amounts earned under the plan for performance in fiscal year 2015 were payable in 2016. No annual cash incentive awards were earned under the plan for fiscal 2016 performance. |

Employment Agreements

The following is a summary of the employment agreements the Company has entered into with each of the named executive officers. The summary below does not contain complete descriptions of all provisions of the employment agreements of the named executive officers and is qualified in its entirety by reference to such employment agreements. Mr. Lewis’ employment agreement was filed as an exhibit to our registration statement on formS-1-registration number333-190893. Mr. Coyne’s employment agreement was filed as an exhibit to form8-K filed on April 8, 2015. Mr. Revord’s employment agreement was filed as an exhibit to our form10-K on February 22, 2017. We have also entered into indemnification agreements with our directors and executive officers. See “Related party Transactions–Indemnification Agreements.”

Aylwin Lewis

Mr. Lewis entered into a new Executive Employment Agreement effective as of August 8, 2013 (the “Lewis Agreement”) pursuant to which he will continue to serve as our President and Chief Executive Officer. Under the Lewis Agreement, the term of Mr. Lewis’ employment continues until August 7, 2017. The Lewis Agreement terminates upon death, disability, termination by us with or without cause or resignation by the executive with or without good reason. If, at least 30 days prior to August 7, 2017, (1) we do not offer to extend Mr. Lewis’ employment past the last day of the term on terms reasonably consistent with the terms of his current agreement or (2) we offer to extend Mr. Lewis’ employment past the last day of the term but the parties are unable to reach an agreement on the terms of such continuing employment by August 7, 2017, then Mr. Lewis’ termination of employment upon expiration of the term of the Lewis Agreement will be treated as a termination by us without cause subject to Mr. Lewis’ requests during negotiations being reasonable and consistent with the terms of the Lewis Agreement. The Lewis Agreement generally defines “cause” as Mr. Lewis’ (i) intentional misrepresentation of material information, (ii) felony indictment, (iii) commission of an act involving moral turpitude, (iv) material breach or material default of written obligations that remain

| | | | | | | | |

| | | | | | EXECUTIVE AND DIRECTOR COMPENSATION |

unremedied for 30 days after notice, (v) fraud, (vi) embezzlement, (vii) failure to comply with our Board of Director’s written lawful direction that remains unremedied for 30 days after notice, or (viii) willful action to harm the Company or its affiliates. The Lewis Agreement generally defines “good reason” as (1) reduction in base salary or target or maximum bonus percentages, (2) materialin 2020 and the remaining 50% of the reduction in position, authority, office, responsibilities or duties, (3) material breach of the agreement by us, (4) Mr. Lewis’ failure to bere-elected to the Board of Directors as Chairman while employed as President and Chief Executive Officer, or (5) relocation to a place more than 50 miles from Chicago, in each case without Mr. Lewis’ consent.February 2021.

A reduction in Mr. Lewis’ rate of base salary or target or maximum bonus which does not exceed the percentage reduction of an across the board salary or bonus reduction for management employees will not be treated as an event of “good reason.”

The Lewis Agreement provides Mr. Lewis with a base salary of $725,000 which shall not be increased. The Lewis Agreement also provides that, under our current bonus program, Mr. Lewis is eligible for an annual target bonus of 100% of his base salary and a maximum (stretch) target of 200% of his base salary. For bonus years beginning 2013, the annual bonus amount and terms and conditions are determined in accordance with incentive plan metrics determined by the compensation committee (but subject to the same targets described in the previous sentence). The compensation committee determined that for fiscal year 2015 the incentive plan metrics applicable to our executive officers were the Company’s total company revenue, adjusted net income, and adjusted EBITDA (where adjusted EBITDA represents net income (loss) before depreciation and amortization expense, interest expense, provision for income taxes andpre-opening costs, adjusted to eliminate the impact of other items, including certainnon-cash as well as certain other items that we do not consider representative of ouron-going operating performance). For fiscal year 2015, the metrics for Mr. Lewis, as an executive officer, were weighted as follows: (a) 40%—total company revenue; (b) 30%—adjusted net income; and (c) 30%—adjusted EBITDA. Beginning with fiscal year 2016, the metrics for Mr. Lewis, as an executive officer, were: (a) 50%—total company revenue; and (b) 50%—adjusted EBITDA. See“—Non-Equity Incentive Awards—2016 Discretionary Bonus” below for a discussion of bonus determinations for fiscal 2016 performance. The Lewis Agreement also provides Mr. Lewis with standard benefits and perquisites, a payment of up to $20,000 for legal fees in connection with the negotiation of the employment agreement and review of related agreements and a minimum four weeks of vacation.

Pursuant to the Lewis Agreement, Mr. Lewis2% merit increase was granted a stock option with a Black-Scholes value of $1,200,000 (227,187 shares) on August 8, 2013(the “Effective Date Grant”). The Effective Date Grant has an exercise price of $10.59. The Lewis Agreement provides that all stock options held by Mr. Lewis prior to the date of the Lewis Agreement (other than the Effective Date Grant) became fully vested on August 8, 2013. The Lewis Agreement also contemplates that Mr. Lewis may be granted equity awards under the Company’s equity incentive plans beginning after August 8, 2015with a target value of $600,000 (subject to increase or decrease as determined by the compensation committee based on performance).

Mr. Lewis is also a party to a confidentiality, noncompetition, noninterference and intellectual property agreement, with the noncompetition and noninterference covenants lasting for one year after termination of employment. For information regarding the severance benefits under the Lewis Agreement as well as the treatment of Mr. Lewis’ outstanding equity awards upon a qualifying termination or a corporate transaction/change in control, see “—Potential Payments Upon Termination of Employment or a Corporate Transaction/Change in Control—Aylwin Lewis Employment Agreement.”

Michael Coyne and Matthew Revord

Mr. Coyne entered into an employment agreement with the Company effective as of May 1, 2015. Mr. Revord entered into a new Employment Agreement effective as of July 25, 2013 and amended effective April 22, 2015. Pursuant to the Employment Agreements, Mr. Coyne serves as our Senior Vice President and Chief Financial Officer and Mr. Revord serves as our Senior Vice President, General Counsel and Secretary. Mr. Revord has since been appointed as Chief Legal Officer. Mr. Coyne’s agreement provides for a base salary of $375,000, and Mr. Revord’s agreement provides for a base salary of $310,000. The salaries may be increased from time to time by the compensation committee at the recommendation of our Chief Executive Officer. The employment agreement for Mr. Coyne provides that he is eligible for an annual target bonus of 60% of base salary. The employment agreement for Mr. Revord provides that for bonus years beginning on or after an IPO, that he shall be eligible for an annual bonus amount to be determined in accordance with incentive plan metrics recommended by the CEO and approved by the compensation committee. For 2016, Mr. Revord was eligible for an annual target bonus of 60% of base salary. For the current bonus year, the annual bonus amount and terms and conditions for each of these executives are determined in accordance with incentive plan metrics recommended by our Chief Executive Officer and approved by the compensation committee. The compensation committee determined that for fiscal year 2016 the incentive plan metrics applicable to our executive officers would be the Company’s total company revenue and adjusted EBITDA (where adjusted EBITDA represents net income (loss) before depreciation and amortization expense, interest expense, provision for income taxes andpre-opening costs, adjusted to eliminate the impact of other items, including certainnon-cash as well as certain other items that we do not consider

| | | | | | | | |

EXECUTIVE AND DIRECTOR COMPENSATION | | | | | | |

representative of ouron-going operating performance). Further, for Mr. Coyne and Mr. Revord, as executive officers, the metrics for fiscal year 2016 were weighted as follows: (a) 50%—total company revenue; and (b) 50%—adjusted EBITDA. See“—Non-Equity Incentive Awards—2016 Discretionary Bonus” below for a discussion of bonus determinations for fiscal 2016 performance. The Employment Agreements also provide the executives with standard benefits and perquisites and a minimum of four weeks of paid time off for Mr. Coyne, and five weeks of paid time off for Mr. Revord. The Employment Agreements contemplate that the executives may be granted equity awards under our equity incentive plans.

Each of the Employment Agreements terminates upon death, disability, termination by us with or without cause or resignation by the executive without good reason. The Employment Agreements for Mr. Coyne and Mr. Revord define “cause” and “good reason” in a manner that is comparable to the corresponding terms in the Lewis Agreement (except with respect to election to the Board and nomination as Chairman of the Board). For information regarding the severance benefits under the Employment Agreements and the treatment of Mr. Coyne’s and Mr. Revord’s outstanding equity awards upon a qualifying termination of employment or a corporate transaction/change in control, see “—Potential Payments Upon Termination of Employment or a Corporate Transaction/Change in Control—Employment Agreements.”

Mr. Coyne and Mr. Revord each continue to be parties to a confidentiality, noncompetition, noninterference and intellectual property agreement, with the noncompetition and noninterference covenants lasting for one year after termination of employment.

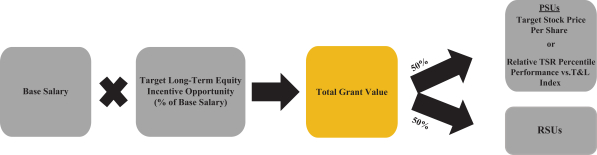

Equity Awards

Equity awards represent an important component of our executive compensation. We believe long-term incentive awards align the interests of our stockholders and our executives by increasing the proprietary interest of our executives in the Company’s growth and success; advance the Company’s interests by attracting and retaining qualified employees; and motivate our executives to act in the long-term best interests of our stockholders. Long-term incentive awards are issued under our Amended and Restated 2013 Long-Term Incentive Plan (the “2013 Long-Term Incentive Plan”), which replaced the Potbelly Corporation 2004 Incentive Plan (provided that awards under the 2004 Incentive Plan will continue to be subject to the terms of the 2004 Incentive Plan). The 2013 Long-Term Incentive Plan provides for grants of options (including nonqualified stock options and incentive stock options), stock appreciation rights, full value awards, and cash incentive awards. The 2013 Long-Term Incentive Plan is administered by the compensation committee. Under our Insider Trading Policy, our directors and executive officers are prohibited from engaging in short sales or investing in other kinds of hedging transactions or financial instruments that are designed to hedge or offset any decrease in the market value of our securities.

The equity compensation for our named executive officers (other than Mr. Lewis) is determined by the compensation committee upon the recommendation of Mr. Lewis. In 2017, the compensation committee engaged Aon Hewitt to perform a review of executive equity compensation. Once that review is complete, the compensation committee will determine the equity compensation for Mr. Coyne and Mr. Revord in recognition of their respective individual performance during the 2016 fiscal year and make a recommendation to the Board with regard to Mr. Lewis’ equity compensation for his individual performance during the 2016 fiscal year. In March of 2016, Mr. Coyne received a grant of 28,145 stock options and Mr. Revord received a grant of 25,331 stock options, each in recognition of his respective individual performance during the 2015 fiscal year. In May of 2015, Mr. Coyne received a grant of 150,000 stock options in connection with the signing of his employment agreement. The equity compensation for Mr. Lewis is determined by the Board of Directors (other than Mr. Lewis) uponin October 2020 for all exempt employees including the recommendation of compensation committee. Mr. Lewis received a grant of 100,000 stock optionsnamed executive officers which increase was implemented in March of 2016 and a grant of 50,000 stock options in May of 2016 in recognition of his individual performance during the 2015 fiscal year. Under the terms of his employment agreement, Mr. Lewis was not eligible to receive equity compensation as part of the Company’s annual incentive compensation program in March 2014 or March 2015.April 2021.